Qualification Assessments

We are approved by the Australian Government's Department of Home Affairs (formerly the Department of Immigration and Border Protection) to offer qualifications assessments for the following accounting occupations:

Accountant (General) |

ANZSCO Code 221111 |

External Auditor |

ANZSCO Code 221213 |

Management Accountant |

ANZSCO Code 221112 |

Taxation Accountant |

ANZSCO Code 221113 |

Finance Manager |

ANZSCO Code 132211 |

Corporate Treasurer |

ANZSCO Code 221212 |

Educational Standards

To meet the educational standards for any of the above occupations, you must have your qualification (with a major in accounting or relevant field) assessed as comparable (in both content and standard) to an Australian Bachelor degree. Your qualification must include adequate coverage of the required core competency areas below.

Core Competency Areas |

Accountant (General)

|

External Auditor

|

Management Accountant

|

Taxation Accountant

|

Finance Manager

|

Corporate Treasurer 221212 |

Basic Accounting |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Cost & Management Accounting |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Financial Accounting & Reporting |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Financial Management |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Economics |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Business Law (including Corporate Law) |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

compulsory |

Statistics |

compulsory

|

compulsory |

compulsory |

compulsory |

compulsory

|

compulsory |

Tax Law |

optional |

optional |

optional |

compulsory* |

optional |

optional |

Auditing & Assurance |

optional |

compulsory |

optional |

optional |

optional |

optional |

*Applicants who apply for Taxation Accountant (ANZSCO Code 221113) must supply completed studies in Australian Tax Law.

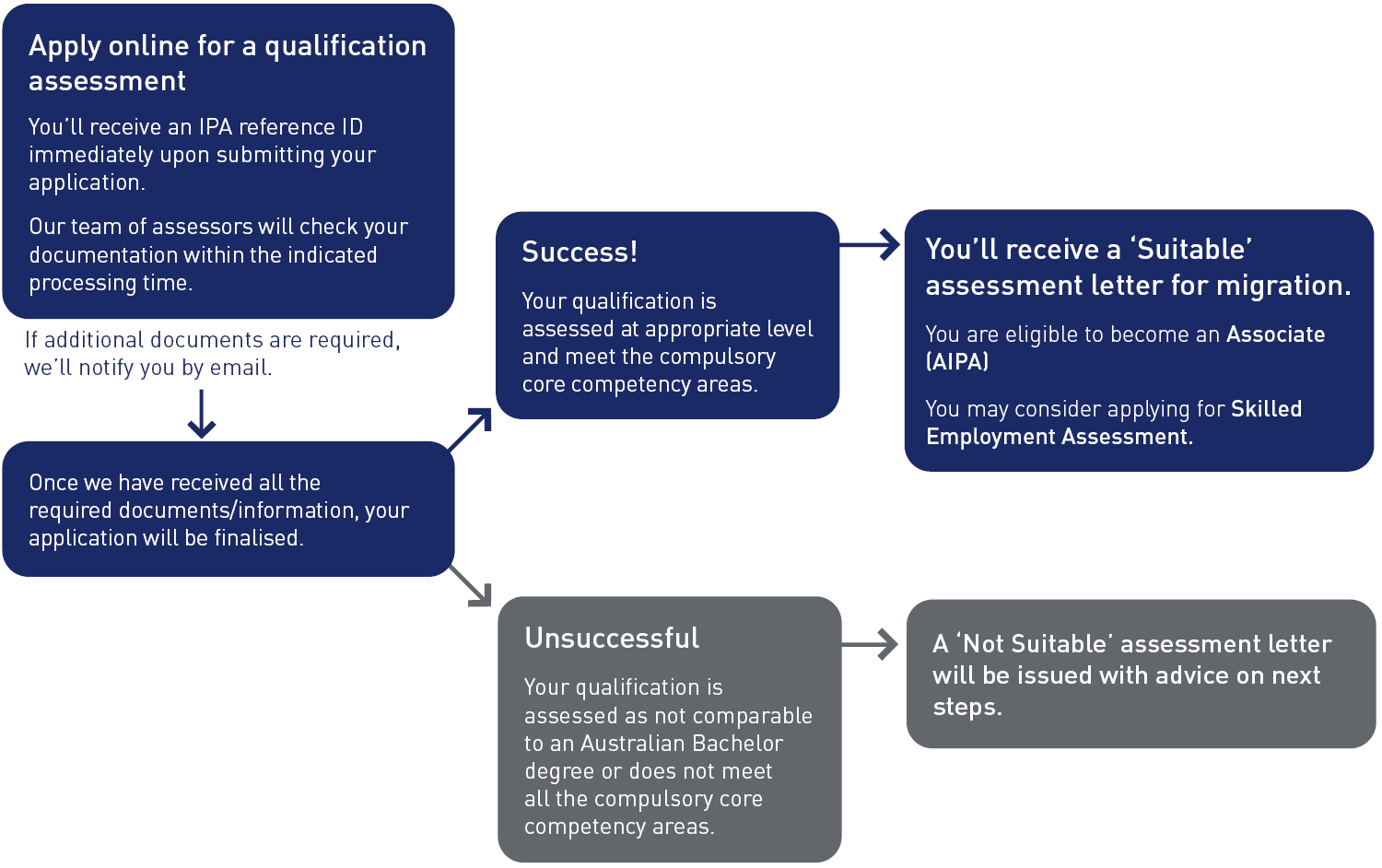

Assessment Process

Current Processing Times

Priority Applications |

Our unique Priority service guarantees a response within 1-2 business days of receiving your application. You can apply for Priority service if you need the outcome for Qualification Assessment / Skilled Employment Assessment urgently. |

Standard Applications |

We are currently providing responses for standard Qualification Assessment applications / Skilled Employment Assessment applications within 7 business days of receiving your application. The processing time is indicative only and can change due to the volume of applications received. |