SBCGT reform – allow more taxpayers in but introduce a cap

11 January 2021

Whilst we wait for much needed holistic tax reform, we need to make some urgent adjustments to some of the existing concessions to make them sustainable. Small business capital gains tax (SBCGT) concessions need urgent reform. SBCGT are the most sought after and valued small business tax concessions. However, changes need to be introduced to this all-important tax concession to ensure future sustainability, according to the Institute of Public Accountants (IPA).

The SBCGT concessions are a package of four different concessions which enable a small business owner to defer or reduce capital gains on a sale of active business assets.

“SBCGT concessions were originally intended to provide a nest egg for retirement and encourage entrepreneurial activity. They were never intended to shelter capital gains of the magnitude we are currently experiencing,” said IPA general manager technical policy, Tony Greco.

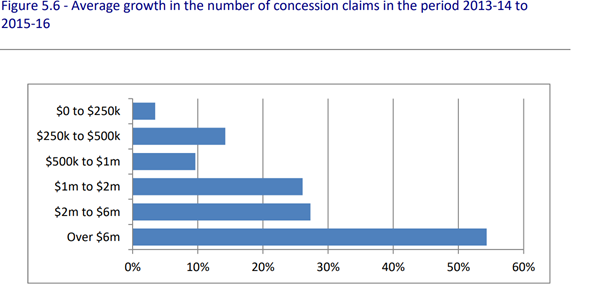

“SBCGT claims grew at 16 per cent over the three-year period 2013-14 to 2015-16, which is, arguably, an unsustainable rate. SBCGT concessions represent one of the largest outlays the Government makes in relation to small business. For example, in relation to the 2015 16 income year (which is the latest year for which data is available), the size of the concessions claimed in absolute terms was $6.2 billion of sheltered capital gains .

“In the 2015-16 income year, claims of $1 million or more represented four per cent of all claims but accounted for some 38 per cent ($2.37 billion) of total amounts sheltered from tax by the concessions1.

“In the same year, there were 25 claims in relation to capital gains of between $6 million and $10 million and a further 15 claims, averaging $10 million per claim. In the previous income year (2014-15) five claimants claimed concessions on capital gains of $400 million, that is, an average of $80 million per claim.

“While all categories of claims are growing over time, claims of capital gains of $6 million or more appear to show the highest rate of growth in recent years in terms of the number of claims and the total value (from $180 million in 2013-14 to $400 million in 2015-16). We anticipate that if this trend continues, the concession may become unsustainable in its current form. The size of these gains that receive preferential tax treatment doesn’t align with the original policy intent and the concept of fairness and equity.

“The way forward as recommended by the Board of Tax in its report to Government on the Review of Small Business Tax Concessions (Board of Tax SB report), which we support, is to increase eligibility by moving the turnover threshold (from $2 million to $10 million) which will allow more businesses to qualify. We also support reducing complexity by removing the net asset value test (NAVT) and collapsing the 15-year exemption, active asset reduction and retirement exemption, and replacing them with one CGT exemption subject to a cap. The NAVT calculations add enormous complexity to the current rules and its removal will significantly reduce compliance costs.

“However, for this to be economically sustainable, it will need the introduction of a cap for the first time, on the size of the benefits that will receive preferential tax treatment under these concessions to ensure a larger proportion of the benefit is not accessed by a relatively small number of businesses.

“This would be a good reform pathway forward to address current issues such as fairness, complexity and sustainability. There are considerable savings to be made which can be directed to other measures such as the small business tax offset.,” said Mr Greco.